> HOME - BLOG > INDUSTRY NEWS >

> HOME - BLOG > INDUSTRY NEWS > Aluminium prices under dual pressure: trade wars and Chinese exports

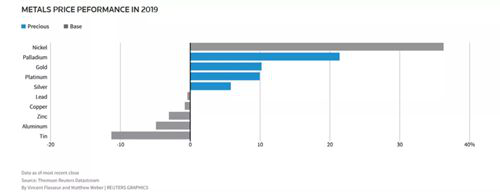

The US President Donald Trump said that he will impose a 10% tariff on the remaining $300 billion of Chinese imports since September 1th. The price of base metals in early August fell to the lowest level in a few weeks. No progress has been made in the round of negotiations. It is clear that the trade war between the United States and China has cast a shadow over the prospects for global economic growth and has had a lasting negative impact on metal demand this year.

Last Friday, aluminum prices hit their lowest level in about a month due to concerns about weak consumption after shrinking Chinese factories. The average aluminum price for the first seven months of this year was $1,821/ton, compared to the average aluminum price for the same period last year of $2,193/ton.

Supply and demand

According to the International Aluminum Association (IAI), global aluminum production fell by 0.5% in the first half of this year to 31.6 million tons. This is not a worrying development, but the fact is that global output has not fallen year-on-year since the global financial crisis in 2009. According to IAI data, China's production in June fell by 3.1% compared with June last year, and fell by 0.4% in the first six months of this year.

Alcoa also reached the same turning point, and for the second time in three months, it lowered its global demand forecast for July, and expects demand growth this year to be 1.25-2.25%. This ratio has fallen sharply compared to 4-4.5% in previous years. In this market environment, the price of aluminum and other base metals can only be pushed up by quickly resolving trade disputes.

China: Summer comes early

According to China Construction Bank's report and its monthly aluminum report in early July, Platt said that due to the bleak market prospects, the Chinese aluminum off-season came earlier this year, despite the stimulus measures.

According to the China Nonferrous Metals Industry Association, due to insufficient demand in the traditional industry, China's aluminum demand growth rate in 2019 is only 1%. To date, economic stimulus measures designed to support demand growth have had little impact on demand. China's aluminum prices will remain weak and are not expected to rise until September.

Uncertainty and wait-and-see methods that prevail in the market will certainly affect demand and aluminum prices. The additional pressure on aluminum prices comes from weak demand and China's record high exports.

The trade deficit with Europe and China has increased - this year will make the United States more likely to impose tariffs on European products, and may affect trade negotiations with China in September. In all of these cases, aluminum prices are unlikely to exceed the $1800-1,850 range per ton for the remainder of the year.

The only optimism is that this will not be the first unexpected price rebound if there is no obvious reason. Uncertainty in the market and the wait-and-see behavior of participants may trigger price increases in an instant, while higher seasonal demand and better economic data from major economies may support price increases. If the US-China trade talks progressed in September (and thus prevent the new 10% tariff), and China's aluminum exports eventually began to decline (but significantly below 200,000 tons/month), this would be more likely. All other scenes are terrible and cannot be considered.

Previous Page:The Development Path Choice of China's Aluminum Processing Industry under the Background of Trade War

Next Page:The contribution of the aluminum foil industry to sustainable consumption